An Important Shift in Federal Student Loan Policy: A Closer Look at the Negotiated Rulemaking Process

The U.S. Department of Education has recently announced a significant development that may reshape federal student financial assistance programs. In light of the One Big Beautiful Bill Act, new negotiated rulemaking committees are being established to craft regulations that will affect the future of student loans and broader institutional accountability. This is a story of transformation—one that calls for us to closely examine the fine points of these proposed changes and their potential impact on millions of students and higher education institutions nationwide.

At the heart of this initiative are two committees: the Reimagining and Improving Student Education Committee, which will focus on adjustments to federal student loan programs, and the Accountability in Higher Education and Access through Demand-driven Workforce Pell Committee, which is charged with modifying accountability measures and defining eligibility for a new Workforce Pell Grant. Both committees will have a critical role in rethinking how federal funds are allocated and managed in the wake of substantial legislative revisions.

Understanding the New Framework for Student Loans

One of the key issues addressed in the recent announcement is the reconfiguration of existing federal student loan programs. The new guidelines will touch on several tricky parts of the system, including:

- The phase-out of graduate and professional PLUS Loans

- The establishment of new federal loan limits

- Simplification of student loan repayment plans

These proposals are designed to make the system less intimidating for borrowers, many of whom have been overwhelmed by complicated pieces of the existing framework. By addressing these confusing bits, the Department of Education hopes to create a system that is clearer and easier to manage for both students and institutions. Yet, as with any major overhaul, there are many little challenges and tangled issues that need to be carefully considered.

Reimagining Student Loans: The Role of the Student Education Committee

The Reimagining and Improving Student Education Committee is tasked with steering through several critical changes. Their mandate includes:

- Evaluating how to implement the new federal student loan limits

- Reviewing the gradual phase-out of certain loan types (such as PLUS Loans for graduate and professional students)

- Reworking repayment plans to simplify the process for borrowers

These initiatives are not merely regulatory adjustments—they signal a paradigm shift in how we support students on their educational journeys. For many, these changes could alleviate the nerve-racking pressures associated with high levels of debt and overly complicated repayment plans. However, as stakeholders from various sectors have learned, even well-intentioned reforms can be loaded with issues, particularly when it comes to implementation.

Table: Key Components of the Proposed Student Loan Changes

| Component | Proposed Change | Potential Benefits |

|---|---|---|

| Graduate and Professional PLUS Loans | Phasing out over time | Reduces heavy reliance on high-interest loans for advanced degrees |

| Federal Loan Limits | Introduction of new caps | Promotes more equitable lending, potentially reducing over-borrowing |

| Repayment Plans | Simplification and streamlining | Eases administrative burdens and provides clearer pathways for debt management |

This table highlights the effort to address various tricky parts of our current system. Yet, as with any change, there will be a period of adjustment where institutions and borrowers must find their way through unexpected twists and turns.

Institutional Accountability and Workforce Pell Grants: A Dual Approach

On the institutional front, the Accountability in Higher Education and Access through Demand-driven Workforce Pell Committee is stepping into a role loaded with problems. Their assignment includes adapting accountability measures and creating new eligibility standards for a Workforce Pell Grant program. The Workforce Pell Grant is envisioned as a tool to ensure that federal financial support aligns more accurately with workforce demands, encouraging educational pathways that match current economic needs.

This effort is exceptionally important for several reasons. First, as policymakers attempt to correct issues that have long plagued college and university administration, the introduction of new accountability measures could pave the way for more transparent and effective management. Second, the new Workforce Pell Grant might provide a super important safety net for students venturing into fields that are critical for community health and infrastructure, yet have historically faced underinvestment.

However, it is also clear that balancing institutional accountability with the need for flexibility is not a straightforward undertaking. Institutions vary widely, and the process of tailoring accountability measures to meet the diverse challenges and fine shades of each entity’s situation is a nerve-racking endeavor. Both committees will need to work in unison to ensure that the reforms benefit all parties involved—students, staff, and institutions alike.

A Closer Look at Institutional Accountability Measures

The plan for new accountability measures is full of problems that require careful thinking. Here are some of the key issues stakeholders may face:

- Measurement Metrics: Determining the right performance metrics to gauge both academic and administrative success.

- Data Transparency: Ensuring that all colleges and universities provide accurate, accessible data while respecting privacy concerns.

- Equitable Evaluation: Crafting standards robust enough to guarantee accountability, yet flexible enough to account for the vast differences between institutions.

- Implementation Roadblocks: Addressing the reality that institutions vary in resources, meaning that one-size-fits-all measures could prove to be more intimidating than helpful.

These are just a few of the subtle parts that need to be sorted out before accountability reforms can be successfully enacted. In addition to impacting policy, these changes also signal a broader commitment by the federal government to ensure that taxpayer dollars are utilized in the most efficient and fair manner.

Addressing the Overwhelming Complexity of Federal Regulation Reform

Revising federal student loan programs and institutional accountability measures is no small feat. This process is bound to be a tangled journey because the current system is riddled with tension between competing priorities: protecting students, ensuring responsible usage of public funds, and balancing the needs of diverse institutions. It’s clear that federal officials will have to poke around specific areas where policies have grown either too complex or too rigid over time.

One of the most nerve-racking aspects of such a comprehensive regulatory revision is predicting how these new rules will be interpreted and applied on the ground. The literature on federal educational policy is replete with cautionary examples of well-intentioned changes that ended up causing new pitfalls. For instance, when payment plans in other sectors underwent similar revisions, they sometimes faltered because the new structures were too intimidating for end users to fully understand. Thus, this is a pivotal moment for federal policymakers—one where getting into the fine details and planning ahead could make all the difference.

Insights from Past Regulatory Revisions

Looking back at previous revisions in federal educational policy, we find a mixed bag of successes and setbacks that provide valuable lessons. Here are some bullet points summarizing key takeaways:

- Clear Communication is Key: In past reforms, lack of clarity in communication led to widespread confusion among borrowers and institutions alike.

- Incremental Implementation Works Best: Sudden, sweeping changes have often resulted in unanticipated operational hurdles.

- Stakeholder Engagement Is Crucial: Frequent and open consultations with all parties—students, financial institutions, and university officials—helped mitigate backlash and ensure smoother transitions.

- Flexibility in Application: Policies that allow for local adaptations can help manage the nerve-wracking variety of circumstances each institution faces.

These lessons underline the significance of thorough prep work, as federal officials now take on a task replete with both hope and uncertainty. The dual committees will undoubtedly rely on historical insights while attempting to craft policies that can stand up to today’s challenges and the ever-changing educational landscape.

Student Perspectives: The Human Element in Policy Reform

At the center of this expansive policy overhaul are the students. For many, federal student loans are a lifeline—albeit one ensnared in a web of tricky parts and complicated pieces. The potential phase-out of certain loan types and the introduction of new regulations bring both relief and uncertainty. Many students have spent years grappling with the nerve-wracking obligations of their current debt structures, and now they find themselves at a crossroads that could redefine their financial futures.

Students have articulated a range of concerns and hopes regarding these regulatory changes:

- Improved Clarity and Simplicity: Many are enthusiastic about the prospect of more straightforward repayment plans that promise to ease the administrative burden on borrowers.

- Concerns Over Transition Periods: There is unease about how long the transition will take and what interim measures will be in place, as any delays or gaps can lead to additional anxiety.

- Impact on Loan Availability: With the planned phase-out of specific loan types, students worry whether new restrictions might limit their access to necessary funds.

- Long-Term Financial Sustainability: There is also hope that more manageable and well-defined loan limits will result in lower overall debt levels for graduates.

These perspectives illustrate that, while policy-making often seems like an abstract and bureaucratic process, its outcomes are intimately tied to personal well-being. Addressing these human dimensions means not only reworking fiscal guidelines but also ensuring that students are well-informed and supported during and after the transition.

Exploring the Workforce Pell Grant: Aligning Education with Economic Needs

The creation of a new Workforce Pell Grant is one of the more innovative proposals emerging from the recent rulemaking effort. Designed to drive economic change, the Workforce Pell Grant aims to offer financial assistance in a way that resonates with demand-driven workforce needs. This initiative suggests a reorientation where federal aid is more directly tied to not only educational outcomes but also economic realities.

This reorientation poses several interesting thoughts and challenges:

- The Connection Between Education and Employment: A Workforce Pell Grant program can open up pathways for students interested in fields that are essential yet often underfunded. This could stimulate targeted growth in areas that are super important to our society—such as healthcare, education, and critical infrastructure.

- Rebalancing Aid Distribution: By aligning loan limits and grants with workforce requirements, the system might better reward fields that directly contribute to community well-being.

- Enhancing Flexibility in Funding: Unlike traditional grants or loans, this approach may allow for a more nuanced distribution of funds, tailoring support to sectors where it is most needed.

- Incentivizing Skills Development: A reoriented aid system can help ensure that students are not only supported through their education but also equipped with the practical skills needed for today’s competitive job market.

The Workforce Pell Grant proposal stands as a promising example of how public policy can evolve to meet emerging economic needs. While the idea itself is innovative, it is full of problems that require careful thought. The fine shades of policy design will need to account for varied educational landscapes, while also ensuring a seamless experience for students who depend on these financial aids.

Potential Benefits of a Workforce-Oriented Approach

This new approach might yield several key advantages if implemented successfully:

- Better Alignment Between Education and Employment: By connecting financial aid directly to workforce demands, students may see improved career prospects and a smoother transition from college to employment.

- Incentives for Institutions: Colleges and universities may be encouraged to adapt their programs to meet the practical needs of the job market, ensuring that the curriculum remains relevant and valuable.

- Greater Transparency: With clearly defined eligibility and accountability measures, both institutions and students will have a better idea of what to expect, which can ease the nerve-racking uncertainties associated with federal aid.

These potential benefits are promising but require thorough consideration of all the little twists that could impact their success. In many ways, this is an experimental phase—a chance to reinvent how government support links directly to economic productivity and social benefit.

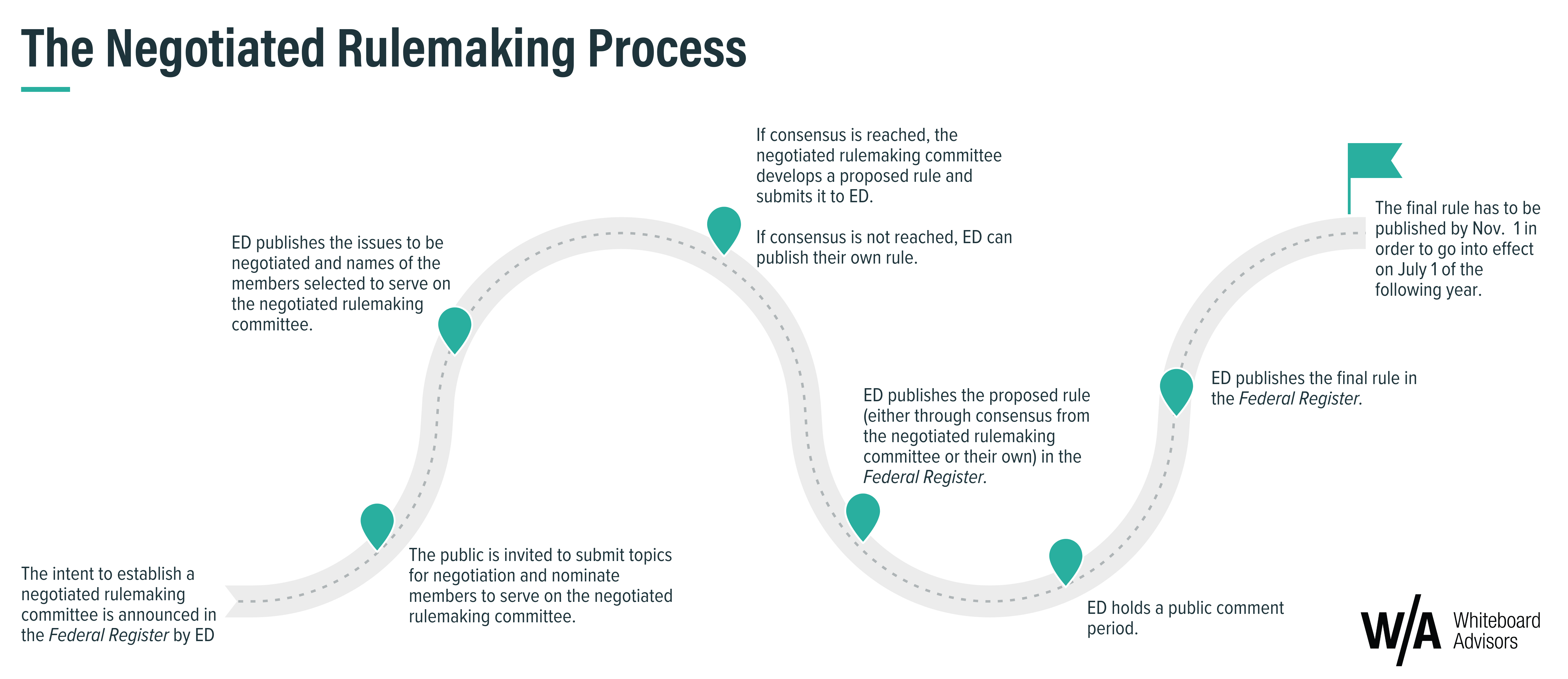

Opportunities and Challenges in the Negotiated Rulemaking Process

The negotiated rulemaking process, in this reimagined context, represents both opportunity and challenge. Elected officials, education administrators, and student communities all have a stake in the outcome of these deliberations. A few of the most pressing questions that arise include:

- How will the rulemaking committees balance competing interests? Both committees must figure a path through a maze of competing demands, where the priorities of students, institutions, and taxpayers can sometimes be at odds.

- What will be the timeline for implementation? The proposed changes come with critical deadlines, including public comment periods that end on Aug. 25. Ensuring accountability during transitional phases is a complicated piece of the overall challenge.

- Can nationwide consistency be achieved? Given the diversity of higher education institutions—from large research universities to small community colleges—any new framework must be adaptable yet consistent enough to promote fairness across all sectors.

Each of these questions underscores the nerve-wracking complexity of attempting such a wide-ranging reform. The process of negotiated rulemaking offers an open platform where stakeholders can dig into the fine details of each proposal. By inviting comments through the federal e-rulemaking portal (docket ID ED-2025-0151), the Department of Education is making it clear that transparency and community input are central to this initiative.

How Stakeholders Can Effectively Participate

If you are an institution, a student, or someone engaged in the higher education community, there are several ways to get involved in this ongoing discussion:

- Submit Comments: Use the federal e-rulemaking portal to share your thoughts before the August 25 deadline. Your insights on how these changes might affect your institution or your personal educational journey are invaluable.

- Engage in Local Forums: Many local educational bodies or advocacy groups are organizing discussions about these changes. Participating in these forums can help amplify your voice.

- Consult Peer Groups: Work through conversations with colleagues or administrative staff to understand the implications of the potential changes. Establishing a collective viewpoint can strengthen your case during consultations.

- Monitor Updates: Keep an eye on official communications from the Department of Education and related bodies such as AAMC. Awareness is key to ensuring that you are not caught unprepared when new policies come into effect.

Participatory processes like these are vital because they ensure that everyone who might be impacted by the policy changes has a chance to contribute. In effect, these public inputs can help steer through many of the hidden complexities of the rulemaking process, ultimately leading to a system that is well-rounded and appropriate for modern challenges.

The Wider Implications for Higher Education

Beyond the immediate impacts to student loans and Workforce Pell Grants, these regulatory changes carry broader ramifications for the higher education landscape. Institutions are likely to face a period of adjustment as they work to align their administrative processes with new federal standards. This transition period may be intimidating for many administrators, academic leaders, and support staff who must figure a path through these convoluted times.

Here are several broader implications to consider:

- Institutional Policy Revisions: Colleges and universities might need to revise internal policies and financial aid processes, a process that can be filled with confusing bits and subtle parts that require detailed planning.

- Budgetary Adjustments: As federal guidelines shift, institutions may have to rethink their overall budget strategies, particularly in areas related to financial aid administration and student support services.

- Public Perception and Trust: Changes in federal policy often impact public trust. A well-implemented overhaul could enhance trust in the higher education system, while missteps could do the opposite.

- Long-Term Financial Health: On a macro level, if these changes help control student debt growth, there could be positive implications for the broader economy, including higher consumer spending and improved financial stability for graduates.

These factors illustrate that the upcoming changes are not simply bureaucratic shifts—they are part of a larger transformation aimed at ensuring that higher education remains sustainable, effective, and aligned with the evolving needs of society. While the road ahead is riddled with challenges, there is also a unique opportunity to remedy long-standing issues and reinforce pathways to academic and career success.

Strategies for Institutions to Adapt to Change

Given the inevitable adjustments that will need to be made, higher education institutions can take several proactive steps to manage their way through this period:

- Review Financial Aid Policies: Institutions should conduct internal audits of their financial aid policies to identify areas that might need overhauls in light of the new regulations.

- Invest in Training: Educate administrative and support staff on upcoming changes to ensure that they can effectively communicate with and assist students during the transition.

- Enhance Communication Channels: Establish clear lines of communication with students, faculty, and external stakeholders to disseminate information about changes and gather feedback.

- Engage with Policy Developers: Institutions should make sure that they participate in public comment processes, thereby helping to shape policies that realistically reflect the operational challenges of modern higher education institutions.

These strategies are not just reactive measures; they are also steps toward building a resilient institutional culture that is capable of adapting to policy shifts. By actively engaging with these processes, educators and administrators can ensure that policy changes bring about improvements that resonate at every level—from the administrative offices to the student body.

Looking Ahead: The Promise and Uncertainty of a New Era

As the federal government embarks on this ambitious journey of reworking student loan programs and accountability measures, it’s important to acknowledge that while the proposed changes are hopeful, the path forward is full of problems that need careful, thoughtful resolution. There is no doubt that the new framework represents a decisive step toward aligning financial aid with both student needs and economic realities. However, as with any profound reform, there are many subtle parts and little details that must be managed meticulously.

The current proposal, characterized by its dual focus on modernizing student loans and revamping institutional accountability, reflects a broader trend: the need for policy that is flexible, transparent, and in tune with the complexities of modern higher education. Federal regulators, institutions, and students alike will need to work together to figure a path through this era of change—a process that will test everyone’s ability to articulate demands, manage expectations, and steer through the myriad twists and turns on the road ahead.

This ongoing dialogue between policymakers and the public is essential. The public comment period ending on August 25 represents an invaluable opportunity for all stakeholders to contribute to a more thoughtful, inclusive process. Every comment submitted is a chance to refine the proposals and ensure that the final regulations are practical, equitable, and effective.

The Dual Path Forward: Reforming Loans and Enhancing Accountability

To sum up the dual objectives at hand:

- Reimagining Student Loans: This path focuses on reducing financial stress for students by simplifying repayment plans, setting new loan limits, and eventually phasing out problematic loan types. The aim is to make the system less overwhelming and more intuitive, reducing the nerve-racking financial burdens that have long plagued many borrowers.

- Enhancing Institutional Accountability and Workforce Funding: This approach aims to ensure that higher education institutions are held responsible for how funds are managed while opening new avenues like the Workforce Pell Grant. The goal here is to forge a shrewd link between education policy and workforce demands, ensuring that financial aid channels support both academic excellence and economic vitality.

Both paths have their own sets of challenges and opportunities. They will require close collaboration among federal authorities, higher education leaders, and the communities they serve. The endgame is not just a more efficient financial aid system but also a reinvigorated educational environment that can better cater to the future needs of our society.

Final Reflections: Transforming Challenges into Opportunities

The newly announced negotiated rulemaking process is a reminder that the landscape of federal regulation is never static. It continuously evolves, often in response to societal needs, technological advancements, and economic pressures. With student loan debt remaining a critical issue for millions of Americans, any reform that promises greater clarity, simplicity, and fairness is cause for cautious optimism.

As we take a closer look at these proposed changes, it is important to remember that every ripple in federal policy can have a far-reaching impact. The revisions set forth by the Department of Education encapsulate a unique chance to not only streamline financial aid but also to ensure that the institutions dispensing this aid are held to well-defined standards. In a sense, this is a pivotal moment where the government is taking the wheel to steer through decades of cumbersome policies towards a future that champions both efficiency and fairness.

Critically, the reform process also offers a moment for introspection: What does it mean for a society to invest in education? And how do we ensure that this investment pays dividends in the form of economic growth, innovation, and personal empowerment? As policymakers and stakeholders dive in to address these questions, there is hope that a more supportive, transparent, and accountable system of financial aid can take shape.

Key Takeaways for a Brighter Future

Before concluding, here are a few super important points to remember as we navigate this evolving landscape:

- The overhaul of student loan programs is aimed at reducing high-interest burdens, making repayment plans more straightforward, and ultimately easing the nerve-racking pressures felt by many students.

- Institutional accountability measures, though currently loaded with issues, could lead to a more transparent and effective system if the fine details are worked through properly.

- The introduction of the Workforce Pell Grant represents an innovative effort to merge education funding with real-world job market demands, potentially opening up new career pathways that are critical for community growth.

- Active participation by stakeholders—through comments, local forums, and ongoing dialogues—is essential for ensuring that the final regulations are both comprehensive and fair.

The education community stands at a crossroads, where the choices made in these negotiations will affect generations of students, educators, and institutions. It is a time to reflect, get into the details, and actively shape the future of higher education funding.

Conclusion: Embracing Change for a More Equitable Higher Education System

This comprehensive shift in federal student loan policy and institutional accountability presents a monumental challenge that is both exciting and intimidating. In the coming months and years, as negotiated rulemaking unfolds and the rules are put into practice, we are likely to witness a transformational period in higher education. While navigating through these tricky parts and tangled issues may be an overwhelming task, the potential benefits—simpler loan processes, improved institutional oversight, and a workforce better aligned with educational pathways—offer a promising horizon.

For students, educators, and policymakers alike, this is a moment to engage, to share feedback, and to collectively forge a more sustainable and fair system of educational support. The vision of a reformed financial aid structure that is both accessible and efficient is on the horizon, and every voice matters as we work together to figure a path toward this new era.

In the end, the proposed changes are about much more than just numbers and policies. They are about investing in the future of our communities, ensuring that every student has the opportunity to pursue higher education without being weighed down by undue financial pressure. It is a call to action—a challenge to transform long-standing, nerve-racking traditions into systems that are not only manageable but also empowering for all involved.

As we watch this process unfold, let us remain engaged, informed, and proactive. The conversation is far from over; in fact, it is just beginning. Together, by working through the nitty-gritty details and addressing even the most complicated pieces, we can create an environment where financial aid works for everyone—mapping out a brighter, more equitable future for higher education in America.

Originally Post From https://www.aamc.org/advocacy-policy/washington-highlights/ed-announces-negotiated-rulemaking-student-loans-institutional-accountability

Read more about this topic at

Trump’s budget bill overhauls the federal student loan …

Congress overhauls federal student loan program